How Does It Work?

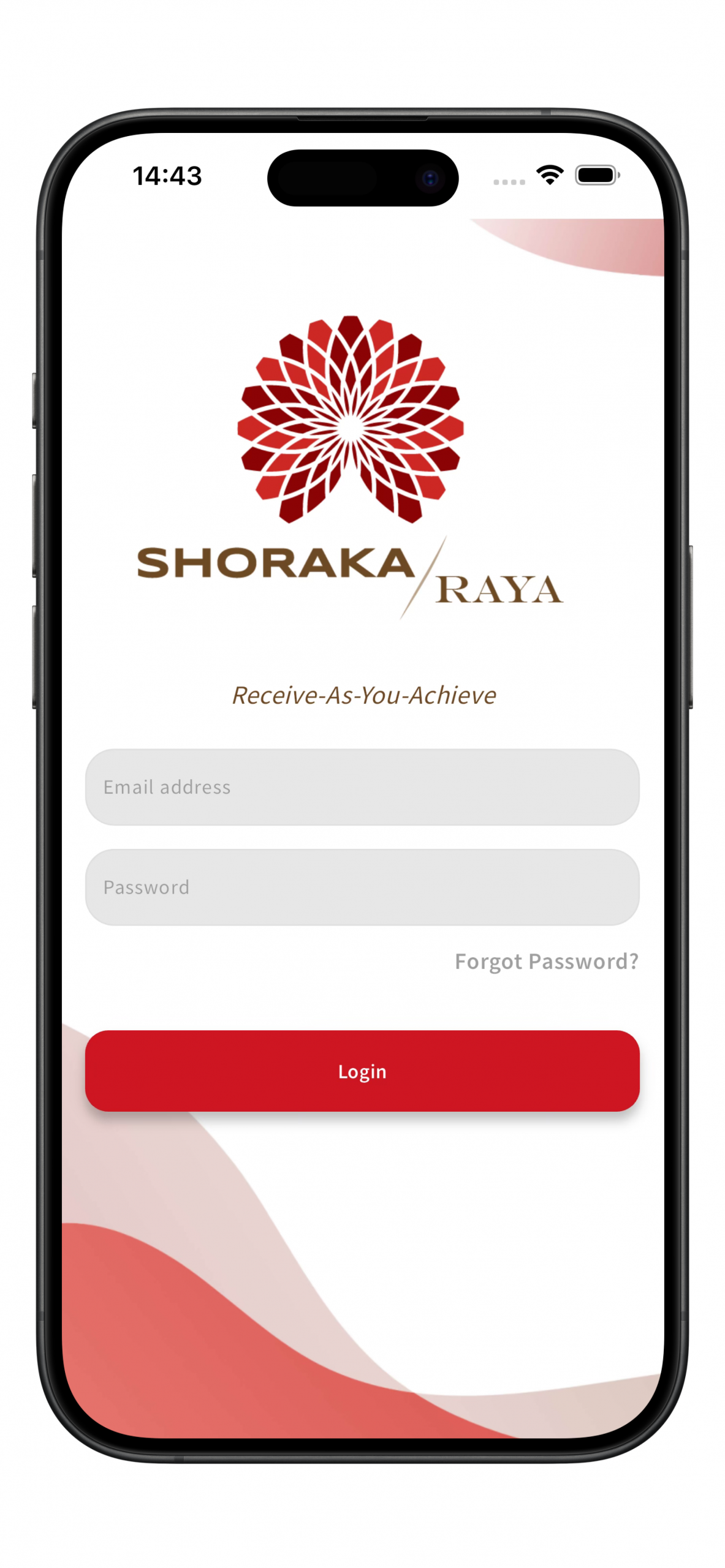

1. Log In to your account

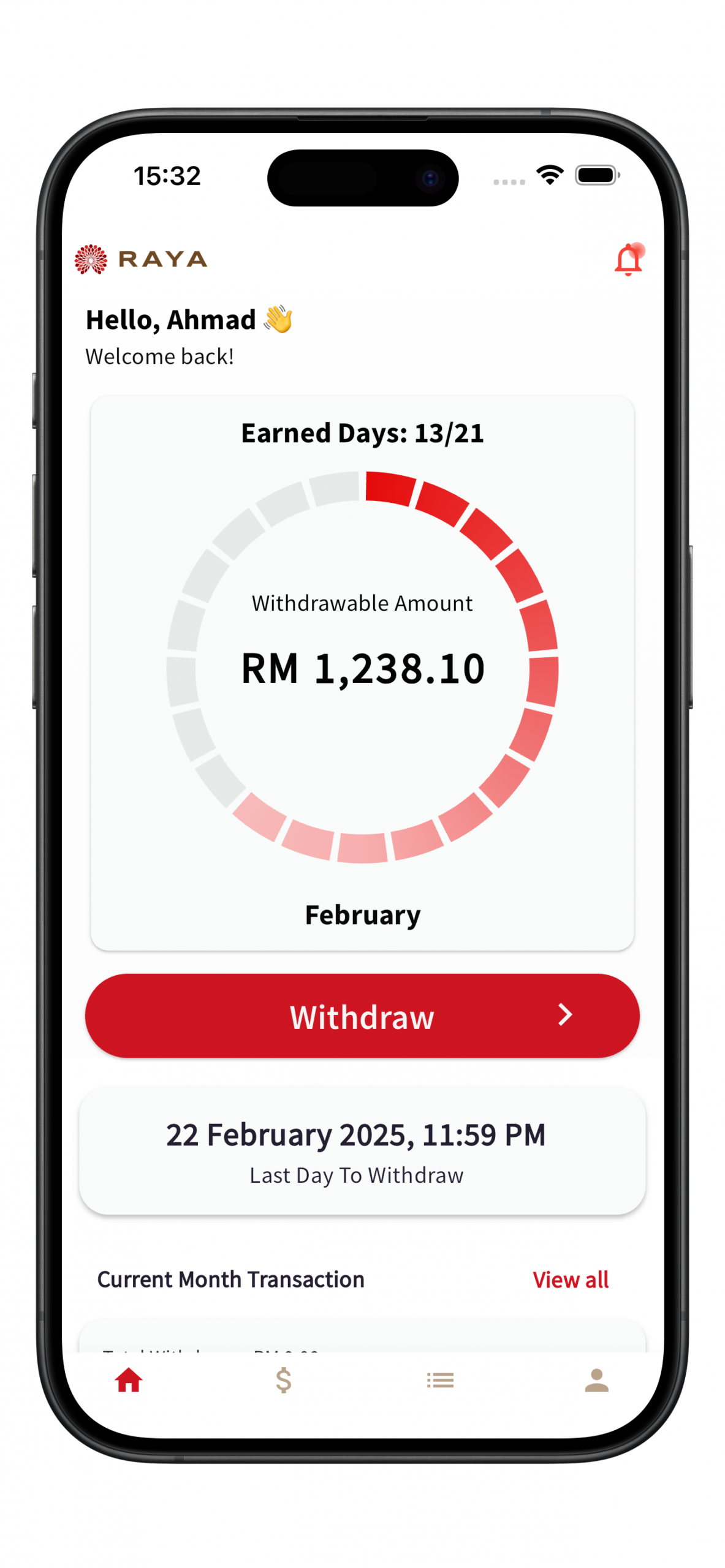

2. Click Withdraw

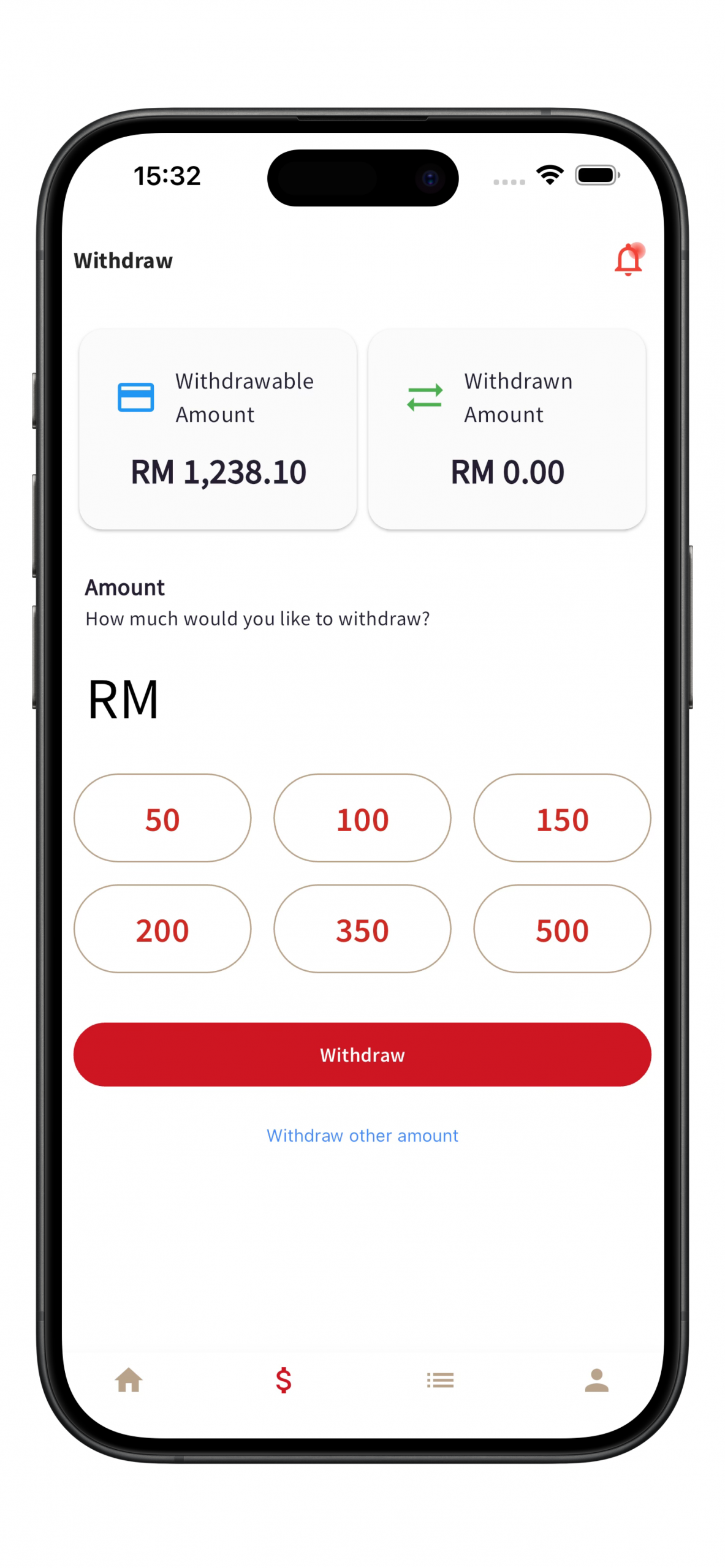

3. Choose amount & confirm

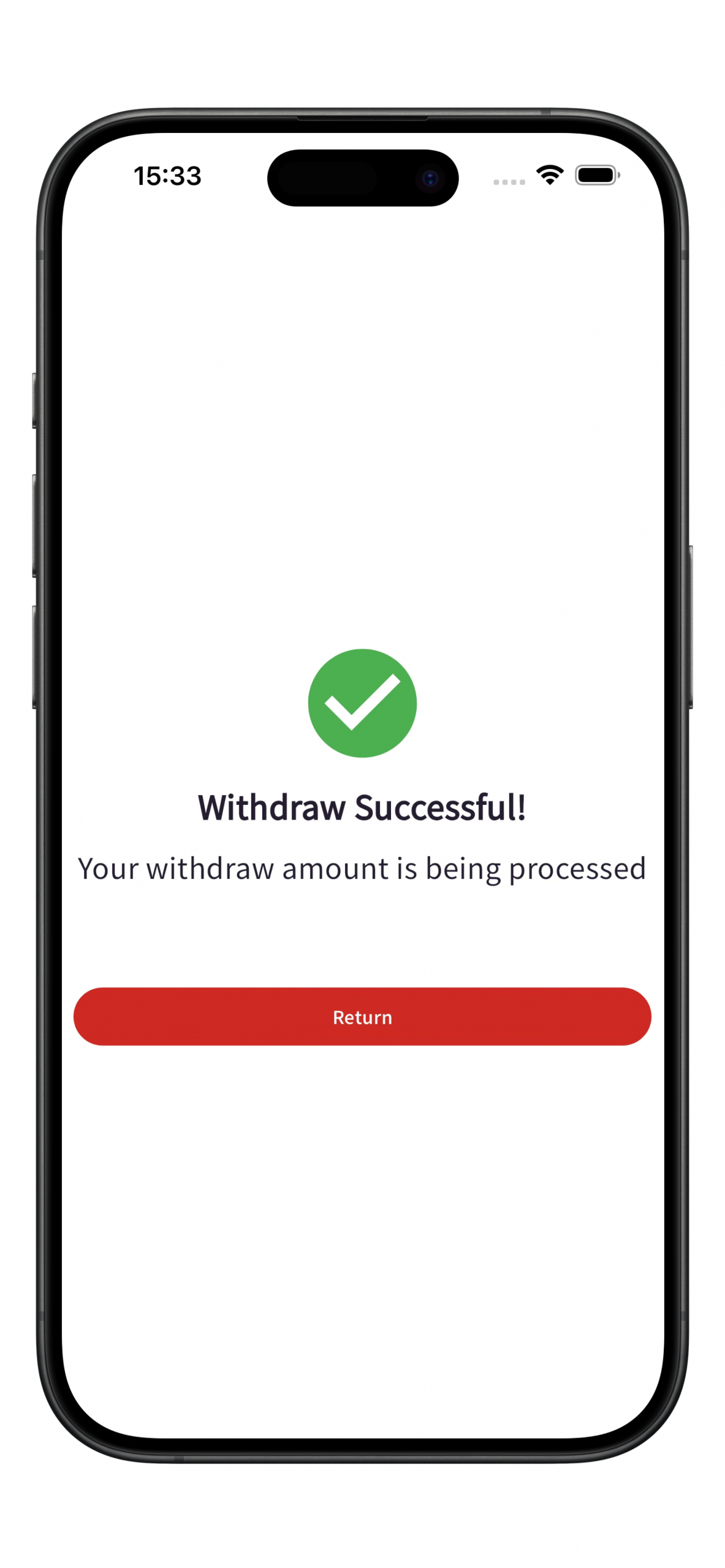

4. Withdraw successful

Who Is RAYA For?

Raya is crafted with the well-being of both Employers and Employees in mind.

FOR EMPLOYERS

RAYA fosters a motivated and content workforce. By offering this benefit, companies demonstrate their commitment to their employees’ financial wellness, increasing Employee loyalty, productivity, and retention.

FOR EMPLOYEES

RAYA offers immediate access to their hard-earned wages, providing a financial safety net for unexpected expenses. With immediate access, Employees gain financial flexibility and peace of mind and enhance overall job satisfaction.

Frequently Asked Questions

What is RAYA?

RAYA is the Earned Wage Access (EWA) mobile app designed to help Employees access a portion of their earned wages before their regular payday.

How does RAYA work for Employers?

Employers must first sign up with RAYA. Then, registered Employees can access the earned wage platform.

How does RAYA work for Employees?

Registered Employees after onboarding can access and withdraw their earned wages until the cutoff date.

Is this a loan for Employees?

No, it is the Employee’s earned wages.

What is the maximum Employees can withdraw?

The maximum you can withdraw is 50% of your earned wages. Employers will have the flexibility to set the amount as per their comfort. RAYA advises not more than 50%.

How many times can Employees withdraw within a month?

Employees can access their earned wages to withdraw as many times as they wish before the salary cutoff date set by the Employer.

How is repayment of withdrawn amounts processed?

Employers deduct the withdrawn amount from the employee’s next pay slip during the regular payroll cycle.

Can Shoraka RAYA be integrated with HR Management/Payroll System?

Yes, RAYA can integrate with most HR management and payroll systems. Contact our technical team to discuss your specific integration requirements.

What ongoing support does RAYA provide to employers?

Our service includes technical support, platform maintenance, regular updates, and dedicated account management.

What are the benefits of integrating RAYA with existing systems?

Integration streamlines operations by automating employee data synchronisation, withdrawal approvals, and payroll deductions, reducing manual work for HR and Finance teams while ensuring accurate record-keeping.